Why Repair Shops Need Smart Tax Automation

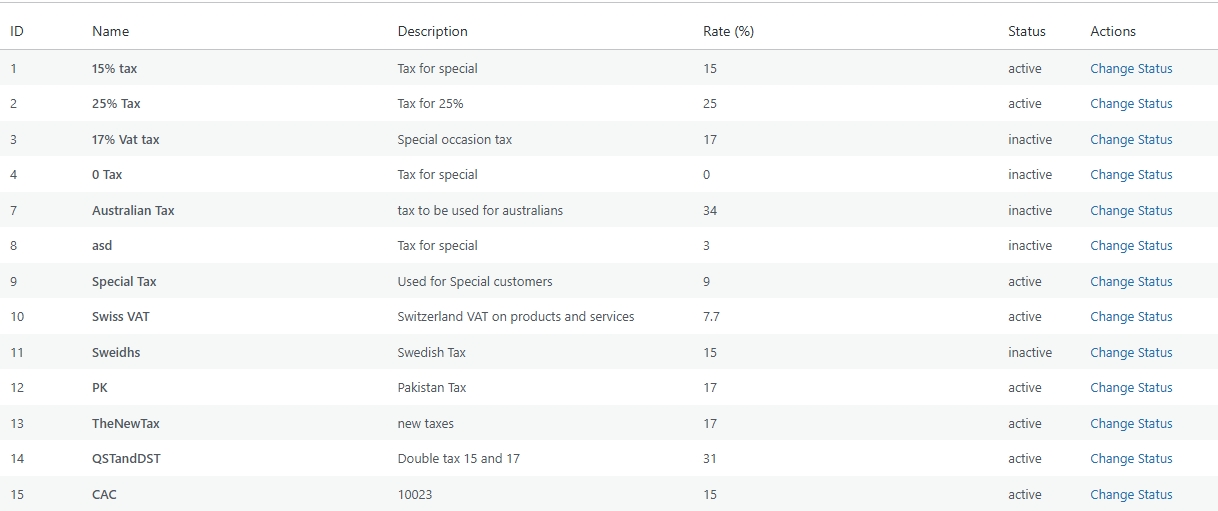

Running a repair business means dealing with different types of items — services, parts, and extras — and each may be taxed differently based on your local tax regulations.

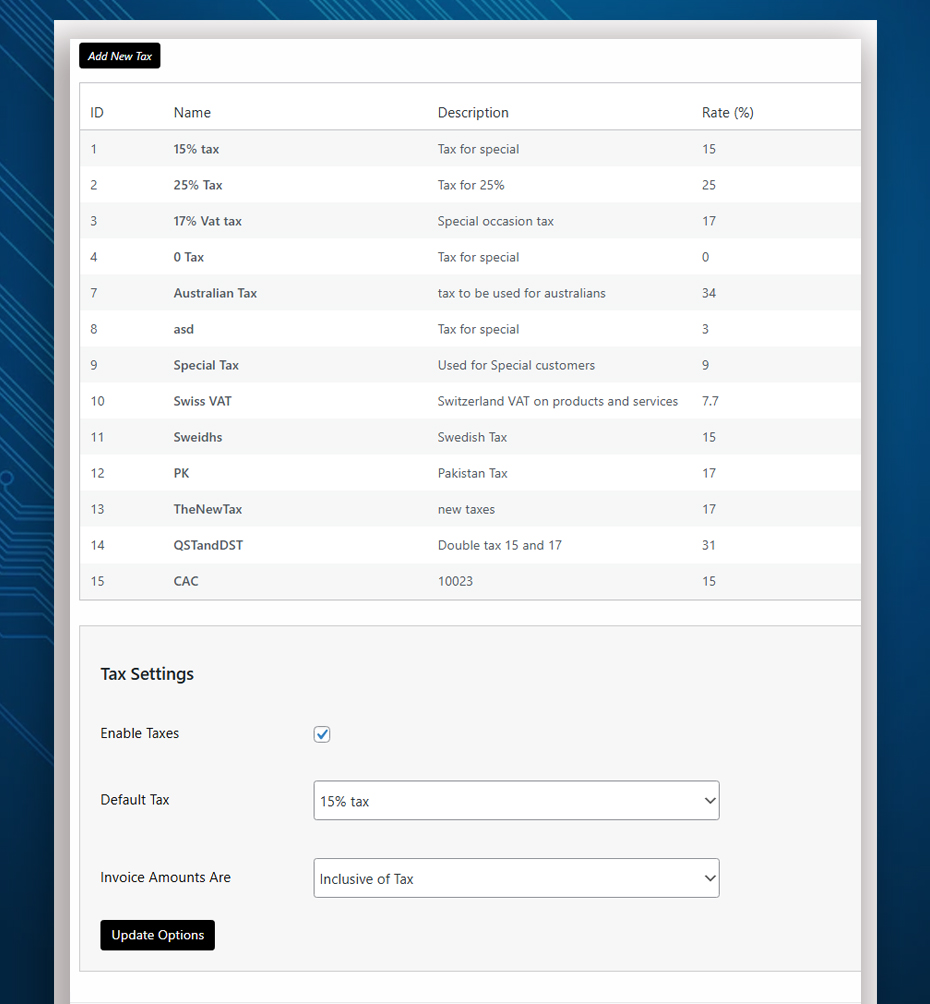

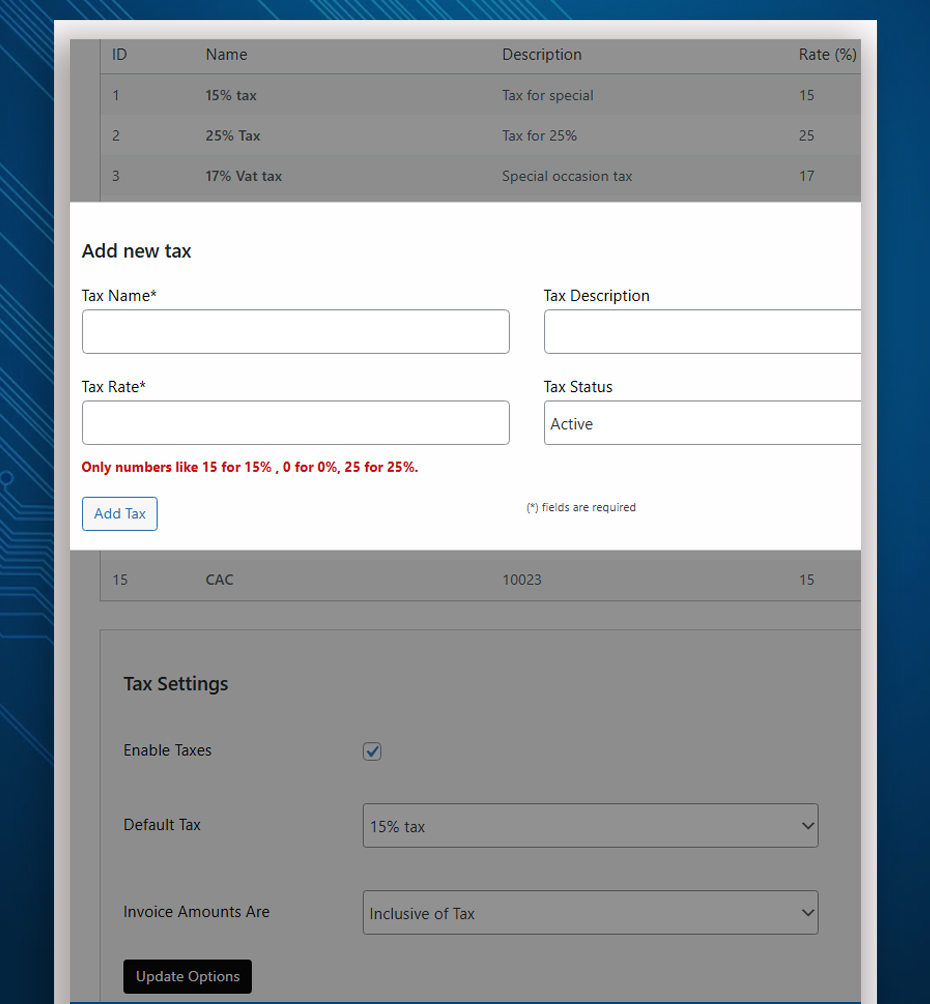

RepairBuddy makes this simple with:

-

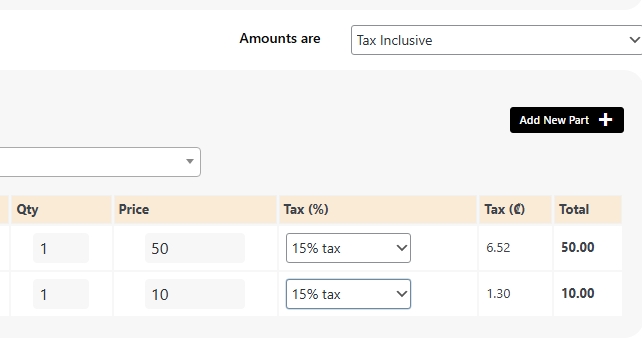

Automated tax calculations

-

Flexible tax settings per item

-

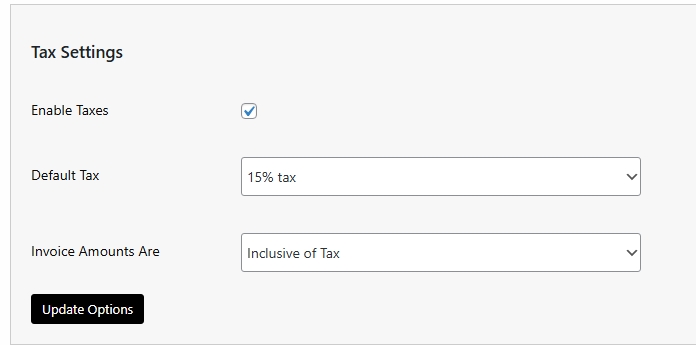

Inclusive or exclusive tax modes

-

Inline tax override on repair jobs

-

Seamless tax reporting

This feature ensures that your invoices are always accurate, legal, and transparent — helping you stay compliant and build trust with customers.